Advanced Controls and Compliance Support for Business Payments

Risk management doesn’t start with a breach. It starts with control. Passport incorporates robust security and compliance features that help finance teams maintain oversight and reduce exposure – without slowing down operations.

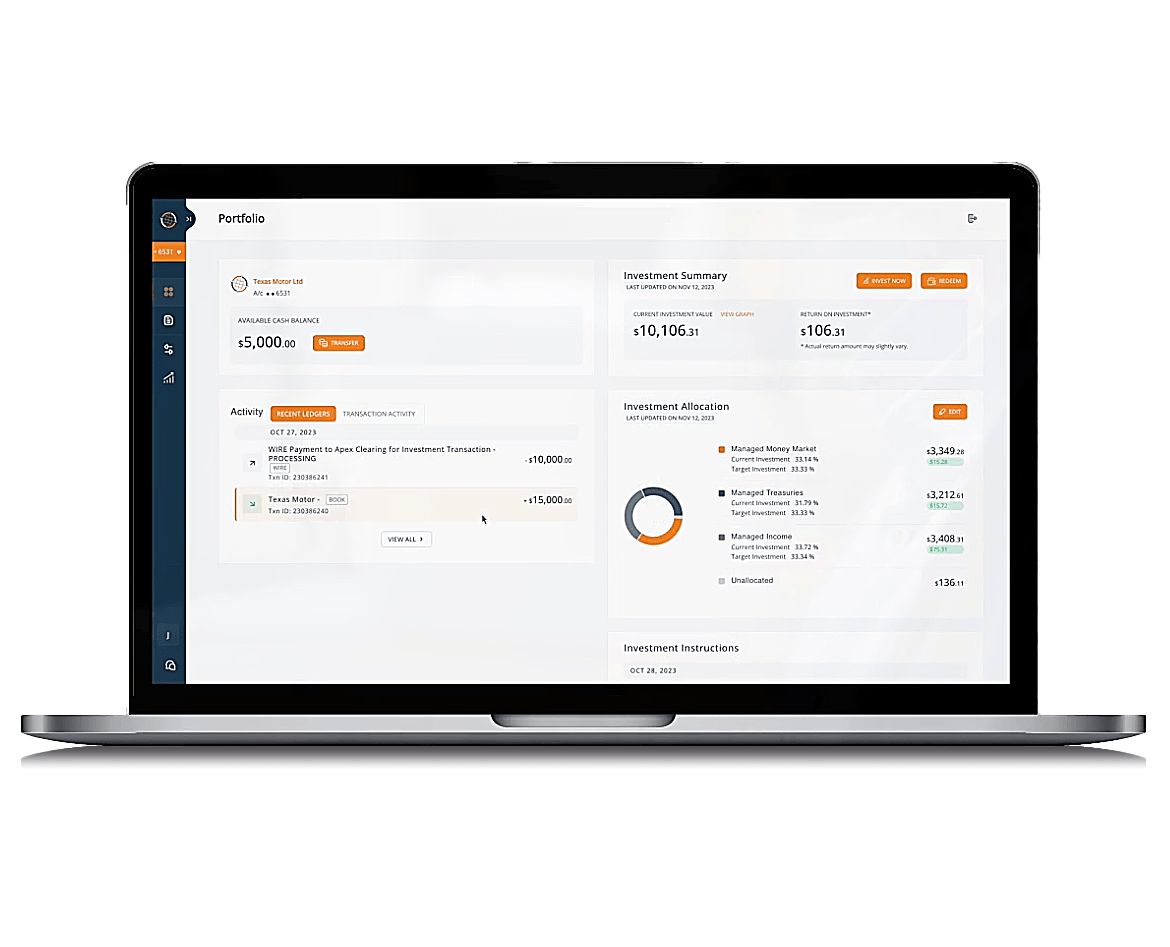

The platform supports role-based access controls, user-level permissions, and approval workflows, so teams can define who sees what, who acts on what, and how funds are moved. This structure supports segregation of duties while maintaining transparency across the entire payment process.

For businesses managing sensitive payment information, Passport uses secure, tokenized transmissions aligned with regulatory best practices. As a PCI DSS compliant payment system, it supports secure handling of cardholder data and card transaction details – minimizing liability and protecting both payer and recipient.

Audit trails are automatically maintained for every action, making Passport a reliable tool for payment audit and compliance tools. Transactions can be traced from initiation to settlement, complete with timestamps, approvals, and reference data – ideal for internal audits or regulatory scrutiny.

And with built-in support for banking transaction monitoring, Passport helps businesses detect anomalies, flag high-risk activity, and comply with operational and institutional standards. For companies operating in regulated industries or complex financial environments, this matters.

Ultimately, Passport functions as more than just a cash management tool – it’s part of a larger strategy for institutional risk management and financial control.