Merchant Services for B2B and SMB Operations

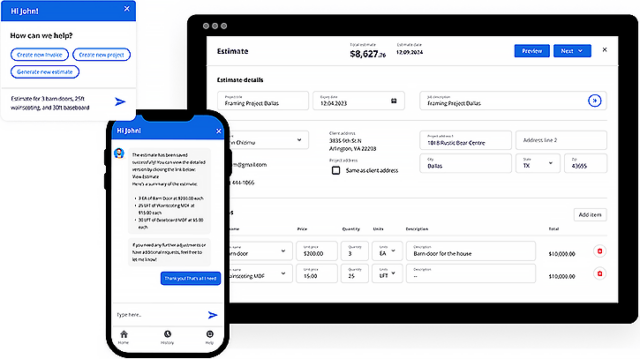

Our B2B merchant services are designed to meet the demands of both growing SMBs and established B2B organizations. These scalable merchant payment solutions help businesses accept payments across various channels — online, in-store, over the phone, and remotely — making transactions seamless regardless of how or where they happen.

By offering flexible options for recurring billing, one-time payments, and high-volume transactions, we support diverse business models and client needs. Whether you’re managing monthly service retainers or field-based sales, our online payment processing platform is built to simplify operations while maintaining speed and security.

With dedicated merchant service support and tools that work across mobile, desktop, and POS environments, we empower businesses to streamline operations and strengthen customer trust with every payment solution.